The FAQ information below is from the State of Massachusetts about the COVID-19 Essential Employee Premium Pay Program.

On Tuesday, the state detailed plans on sending $500 checks to 500,000 low-income workers in Massachusetts starting in March, 2022.

HOW THE PAYMENTS WORK

Q. Do I need to take any action to receive this payment?

No. If you are eligible to receive a payment from this program, you will automatically receive the payment in the form of a check that will be mailed to you.

Q. How many rounds of the premium pay program will there be?

The first round of payments will be made based off 2020 returns. Following tax filing season, the next round of payments will be made using information from 2021 returns. After that, the program will be evaluated for any additional rounds.

ELIGIBILITY

Q. Are payments being sent to workers in certain industries?

No, your eligibility is not determined by the industry in which you work. You are eligible for a payment if your income from employment in 2020 was at least $12,750 and your total income puts you below 300% of the federal poverty level, based on filed 2020 Massachusetts tax returns.

Q. How do I find out what my gross income was in 2020?

Gross income is defined as federal adjusted gross income for tax year 2020. To find your federal adjusted gross income, look at your 2020 Massachusetts Form 1, or at line 11 of your 2020 U.S. Form 1040.

Q. What is income from employment?

Income from employment means compensation paid in connection with work you did in 2020, as opposed to retirement income, investment income, or other income not associated with a job. More specifically, income from employment would have been reported on Line 3, Line 6a, Line 6b, or Line 7 (non-passive income only) of your Form 1 for 2020.

Q. I filed for unemployment in 2021 and 2019, am I eligible for a payment?

If you claimed unemployment compensation in 2020, you are not eligible for a check in round 1 of the premium pay program. However, unemployment compensation in 2019 or 2021 does not affect eligibility for a round 1 check, so long as you are otherwise eligible based on residency and income.

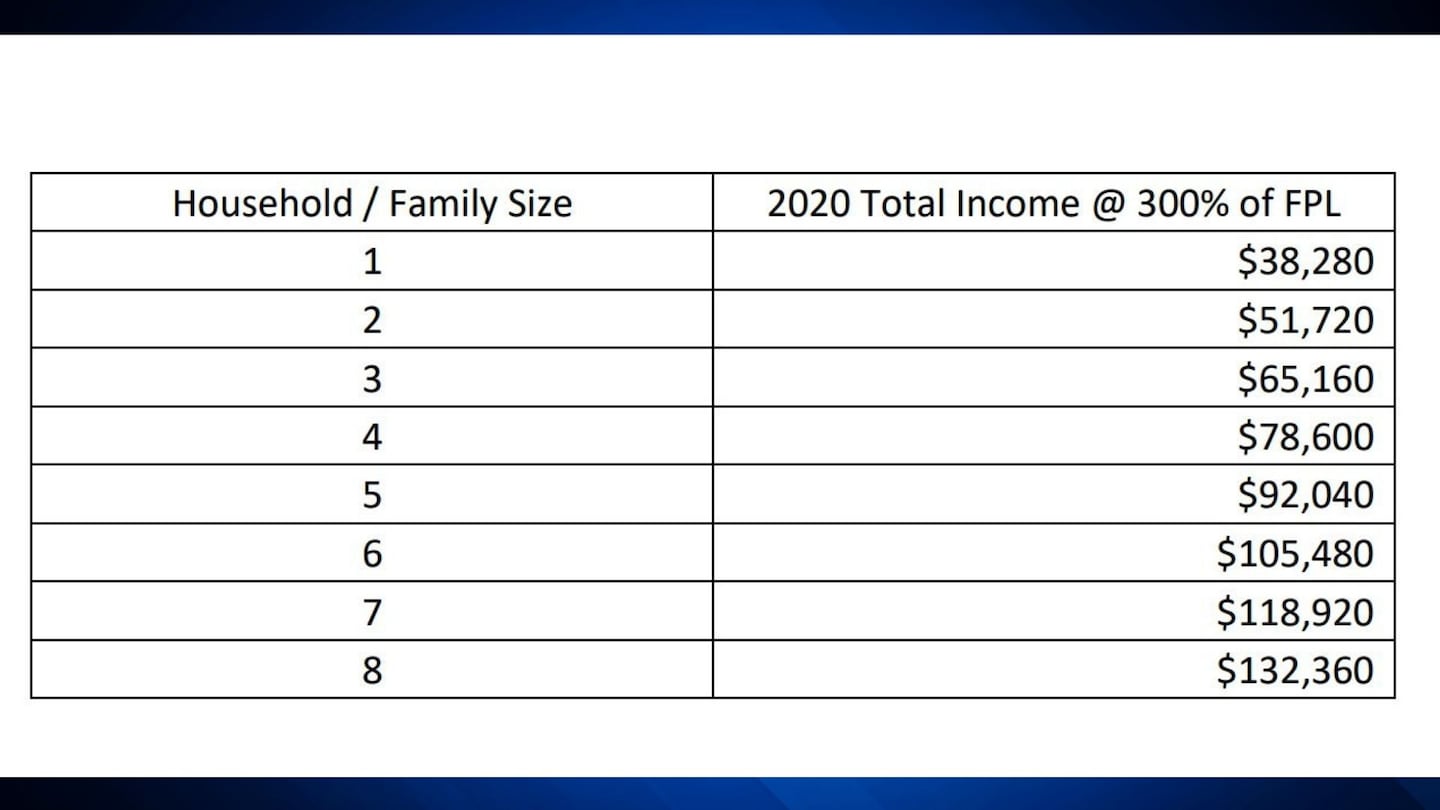

Q. What does three times the federal poverty level mean?

The U.S. Department of Health and Human Services creates a table each year as a guideline for gauging the “poverty line”; income below this level implies a household is living in poverty. The poverty level increases for households with more people living in them. This table is used by states and the federal government to set eligibility for various programs, including this program, often by using a multiple of the Federal Poverty Level in order to set a uniform cutoff for lower or middle income households.

Here’s the chart for 300% of, or three times, FPL for 2020:

For family size greater than 8, add $13,440 for each additional member to calculate 300% of FPL.

Q. My spouse works part-time, and we file jointly. Are we both eligible to receive a payment?

Each spouse must be independently eligible in order for that spouse to receive a payment. In other words, each spouse must 1) be a resident on or after March 10, 2020; 2) have 2020 earnings from employment of at least $12,750; and 2) have no unemployment compensation in 2020. Additionally, you and your spouse’s total income (federal adjusted gross income) cannot be greater than 300% of the federal poverty level ($51,720 for a family of two, or more if you claim other dependents on your taxes).

Therefore, it is possible that neither spouse, or only one spouse, or both spouses would be eligible for a payment.

Q. I made below the minimum threshold in 2020 but was within the range this past year. Will I be eligible in a future round?

Further information on future rounds will be available this summer. Please note that income thresholds may be adjusted for 2021, as both the minimum wage and the Federal Poverty Level figures changed from 2020 to 2021.

Q. What should I do if I have questions about my eligibility?

A call center to answer questions will be available in the coming weeks.

Download the FREE Boston 25 News app for breaking news alerts.

Follow Boston 25 News on Facebook and Twitter. | Watch Boston 25 News NOW

©2022 Cox Media Group