BOSTON — If you’re looking to buy a home in or around the two biggest cities in Massachusetts, it won’t be cheap.

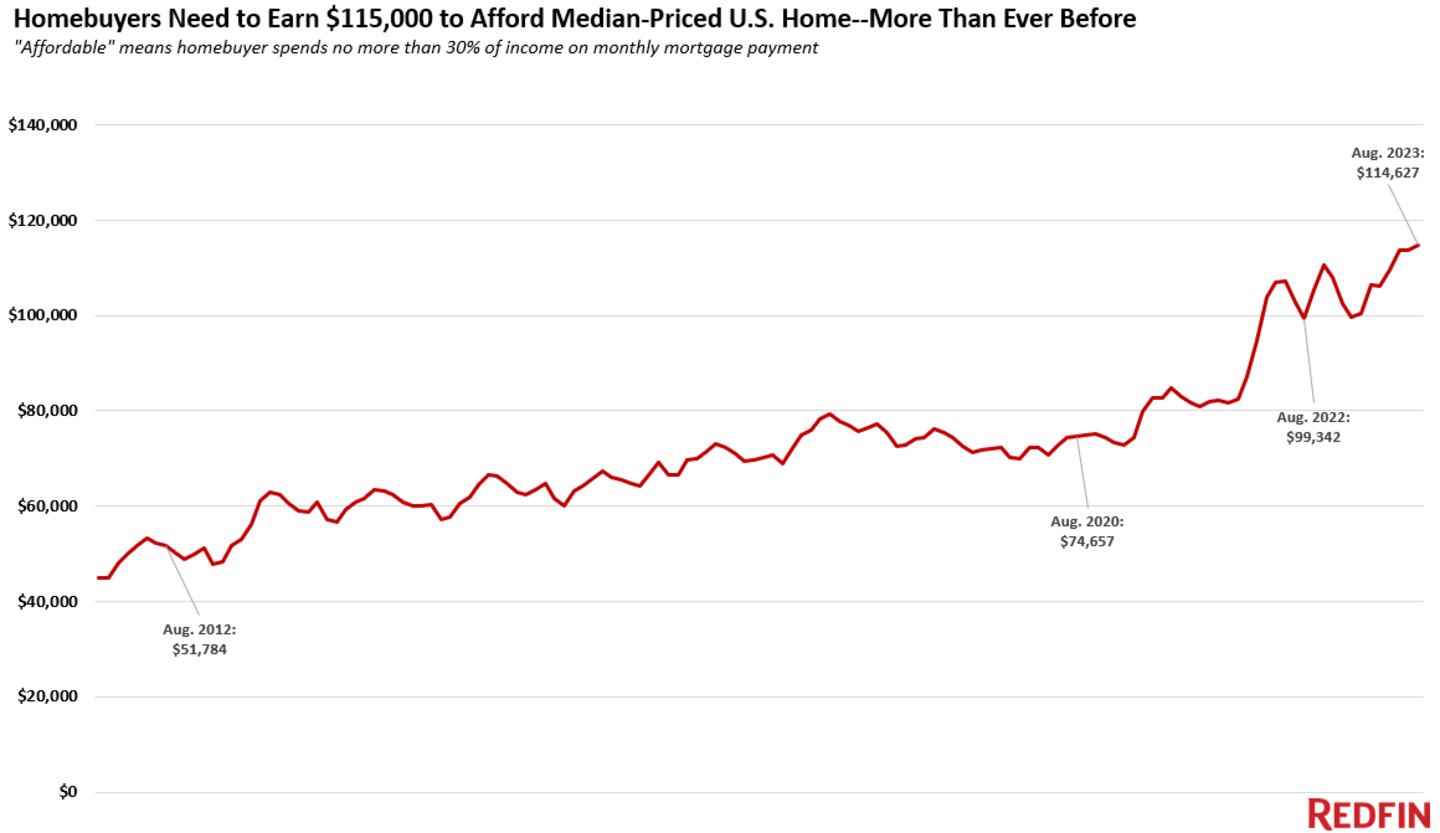

A recent report from real estate company Redfin found that the typical American household needs to make an annual income of at least $115,000 to afford a median priced home. That’s already $40,000 more than what the average household makes, according to the report.

But if you’re looking to buy around Boston or Worcester area that income needs to be even more.

In the Boston metro area, the annual income required to afford a median-priced home was $194,188 as of August 2023. That’s a year-over-year increase of 22.7%, according to Redfin. The median monthly mortgage payment is $4,855 and the median home sale price was $712,000.

In the Worcester area, homebuyers need an income of $118,640. The median home sold for $435,000 with a monthly mortgage payment of $2,966.

According to experts, there are several indicators behind this report including:

- Housing costs are higher than ever because of the one-two punch of sky-high mortgage rates and rising home prices. The typical U.S. home sold for about $420,000 in August which is up 3% year over year and just about $12,000 shy of the all-time high hit in mid-2022.

- The typical U.S. homebuyer’s monthly mortgage payment is $2,866, an all-time high. That’s up 20% from $2,395 a year earlier, and by that time payments had already increased substantially from the beginning of the pandemic, a time of ultra-low mortgage rates and yet-to-skyrocket home prices.

- The typical American household earns about $40,000 less than the income needed to buy a median-priced home. Hourly wages have risen in 2023, but not nearly as fast as the income necessary to afford a home is rising: The average U.S. hourly wage has increased by about 5% over the last year.

- Affordability is less of a problem for all-cash and move-up buyers. The major increase in income necessary to afford a home hits first-time homebuyers hardest. Buyers who can afford to pay cash aren’t impacted by high mortgage rates, and they likely earn more than the income necessary to purchase a home, anyway. Buyers who are selling a home to buy another one are in a better boat than first-timers because they have likely built up equity in their current home, which takes a bit of the sting out of soaring monthly payments.

This is a developing story. Check back for updates as more information becomes available.

Download the FREE Boston 25 News app for breaking news alerts.

Follow Boston 25 News on Facebook and Twitter. | Watch Boston 25 News NOW

©2023 Cox Media Group