BOSTON — There’s a new device that is marketed as a tool for detecting credit and debit card skimming devices at cash registers and gas pumps.

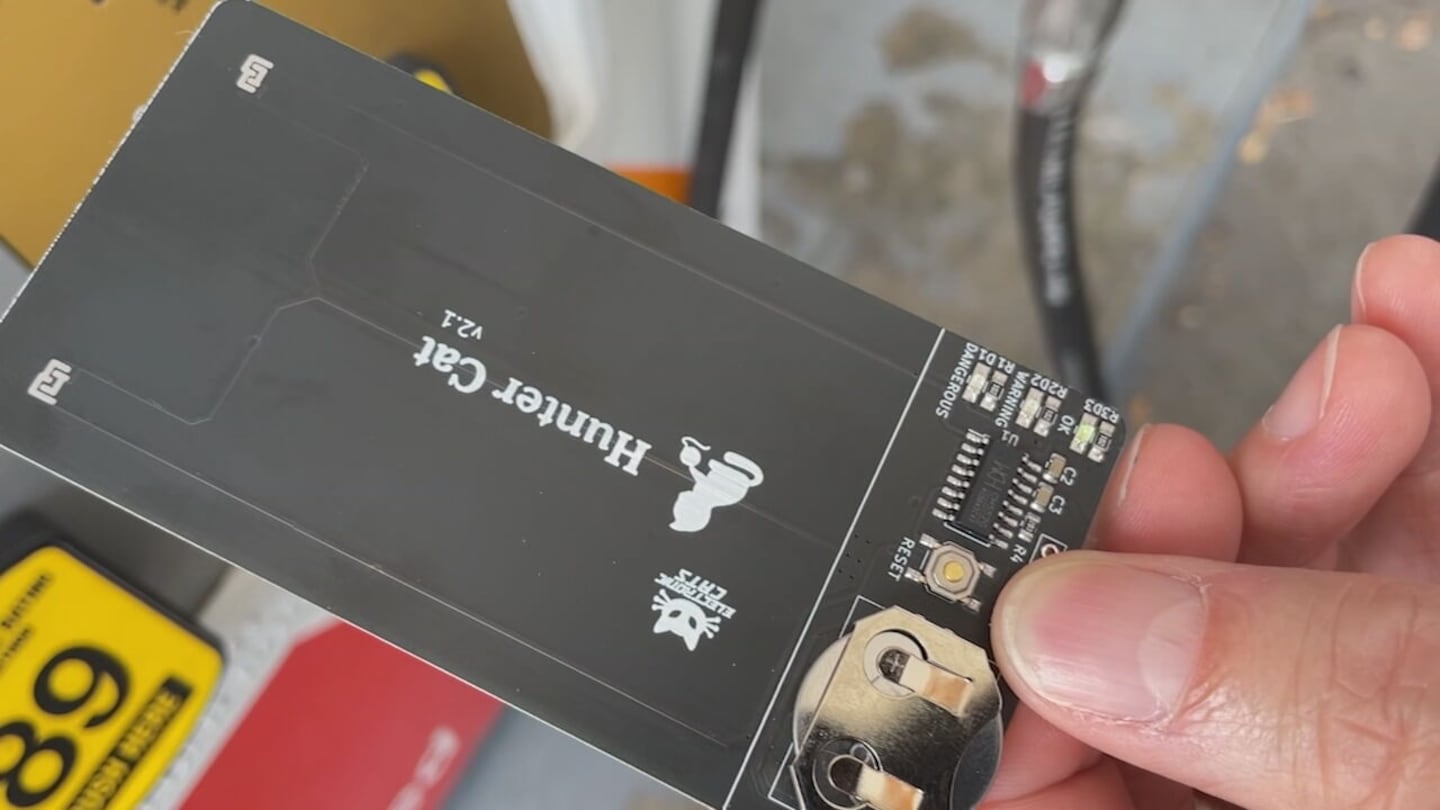

It’s called the Hunter Cat, a $45 credit card-shaped device powered by a coin battery. Its creators say it can detect skimmers by alerting you if there’s an extra device reading your card.

“You have a big problem right there and you can avoid it with this kind of device,” said Eduardo Contreras, the Hunter Cat’s co-creator.

Skimming remains a “big problem” despite evolving technology and efforts to move consumers away from inserting credit and debit cards into card-reading slots. The FBI estimates skimming costs financial institutions and consumers more than a billion dollars every year. Earlier in November, police announced a large skimming ring discovered in at least half a dozen New Hampshire and Massachusetts grocery stores.

We tested the Hunter Cat at half a dozen gas stations along Route One in Norwood and Walpole. We didn’t find anything in our small sample, but a U.S. Secret Service agent told our sister station in Atlanta that the Hunter Cat does have some merit.

“This device will work on a limited number of credit card slots, but not on everything, and that’s basically because of the [evolving] technology,” said Special Agent in Charge Steven Baisel.

If the Hunter Cat doesn’t sound like something you’d spend $45 on, there are other ways you can protect yourself from skimming devices.

Police say the telltale sign of a skimming device is when the chip reader slot is “inoperable and appears jammed,” forcing shoppers to swipe their cards instead. There are also apps like Credit Skimmer Locator and Skim Plus that say they can detect a thief’s Bluetooth signal. Thieves often transmit your stolen data to their computer or smartphone.

Boston cyber security consultant and ProtectNowLLC.com CEO Robert Siciliano said shoppers need to check their bank and credit card statements every day. By turning on push notifications, consumers can receive alerts every time a purchase—suspicious or otherwise—is posted on their account.

“It’s unfortunate that most people aren’t paying attention to their statements and they’re allowing fraud to go unchecked,” Siciliano said. “I think reactively, you just have to pay attention to your statements in real time and make sure there are no fraudulent or unauthorized activities.”

Siciliano also recommends consumers use a credit card over a debit card—its easier to dispute fraudulent charges with a credit card—and if available, always tap your card at checkout or the pump.

Download the FREE Boston 25 News app for breaking news alerts.

Follow Boston 25 News on Facebook and Twitter. | Watch Boston 25 News NOW

©2023 Cox Media Group