BOSTON — In much of the US, landlords pay real estate brokers to help them rent out their apartments.

But that isn’t the case in a handful of states: including Massachusetts, New York and New Jersey.

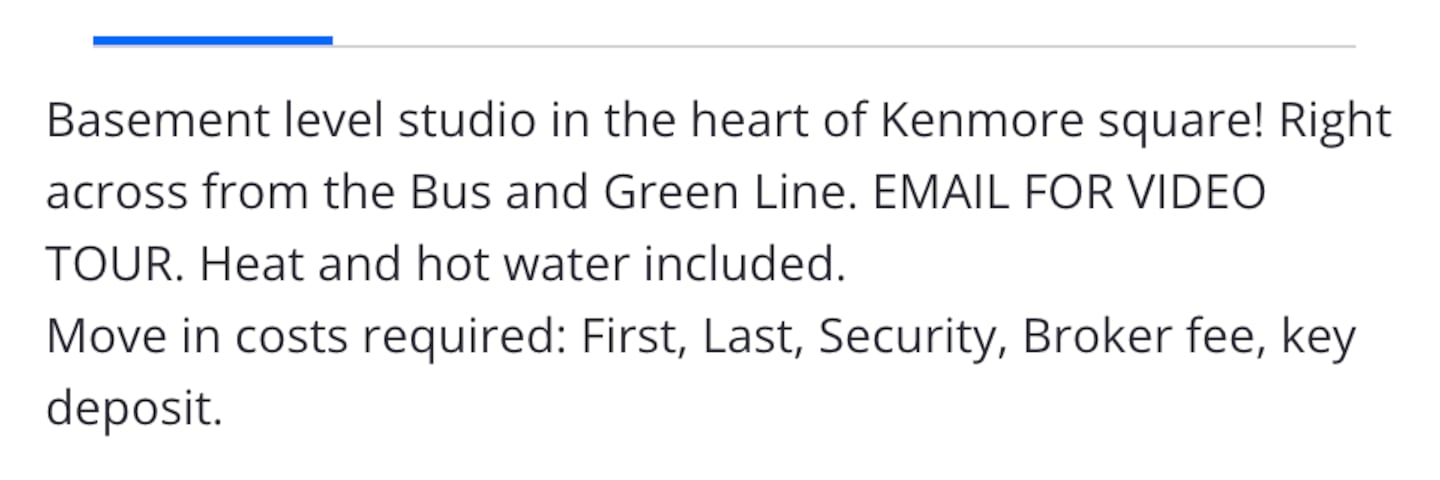

Here, tenants in the competitive Boston rental market may find themselves paying a broker fee equivalent to one-month of rent to secure an apartment – even if they didn’t choose to use a broker in the first place.

That can put the upfront cost of renting an average 1-bedroom apartment at $11,000 – for first month rent, last month rent, security deposit and a broker fee.

Brokers can help provide prospective tenants with individual assistance finding apartment listings.

Prospective tenants may also get a walk-through of a rental property with a broker.

But several tenants interviewed by 25 News Reporter Drew Karedes said they wonder why brokers can earn potentially thousands of dollars for listings that tenants find by themselves on sites like Craigslist or Zillow.com.

Olivia Ford, a 23-year-old Pittsburgh transplant who rents an apartment in Boston’s North End with a roommate, said she first learned about broker fees when touring an apartment she found online herself.

The broker told her to get the apartment, she had to shell out a $1,500 broker fee.

“For it to be an entire month of rent – that’s obscene to me,” Ford, who graduated from college this year, told 25 News Reporter Drew Karedes.

So, why do tenants have to pay the brokers’ fees in MA themselves?

25 News filed records requests with state governmental agencies and spoke with housing and industry experts to get answers.

What we found: Requiring tenants to pay fees for brokers they don’t choose has been custom in communities including the greater Boston area for years, and elected officials haven’t banned the practice.

“A lot of people want to move into the city and a lot of brokers are realizing that they can capitalize on that,” Boston’s Office of Housing Stability Deputy Director Danielle Johnson said.

Johnson said low vacancy rates and the lack of state regulation often benefit landlords.

That means landlords are able to pass on the broker cost to tenants.

Real estate industry groups argue that requiring tenants to pay broker fees is simply a function of the death of available housing in Boston’s highly competitive market at a time of rising interest rates.

“And so what we have ultimately is a supply problem and we’re not producing enough apartments to meet the needs of the city and our population growth in the city of Boston and Greater Boston,” Boston Pads CEO Demetrios Salpoglou said.

But other experts who want increased oversight and potential bans on the fees say they can worsen the housing crisis and disproportionately impact low-income tenants.

“Allowing landlords to pass the broker fee on to tenants with rents skyrocketing in the Boston area squeezes renters that are struggling with the high cost of housing,” Suffolk University law professor James Matthews said. “And exacerbates the affordable housing affordability crisis that we’re seeing in a lot of communities across Massachusetts.”

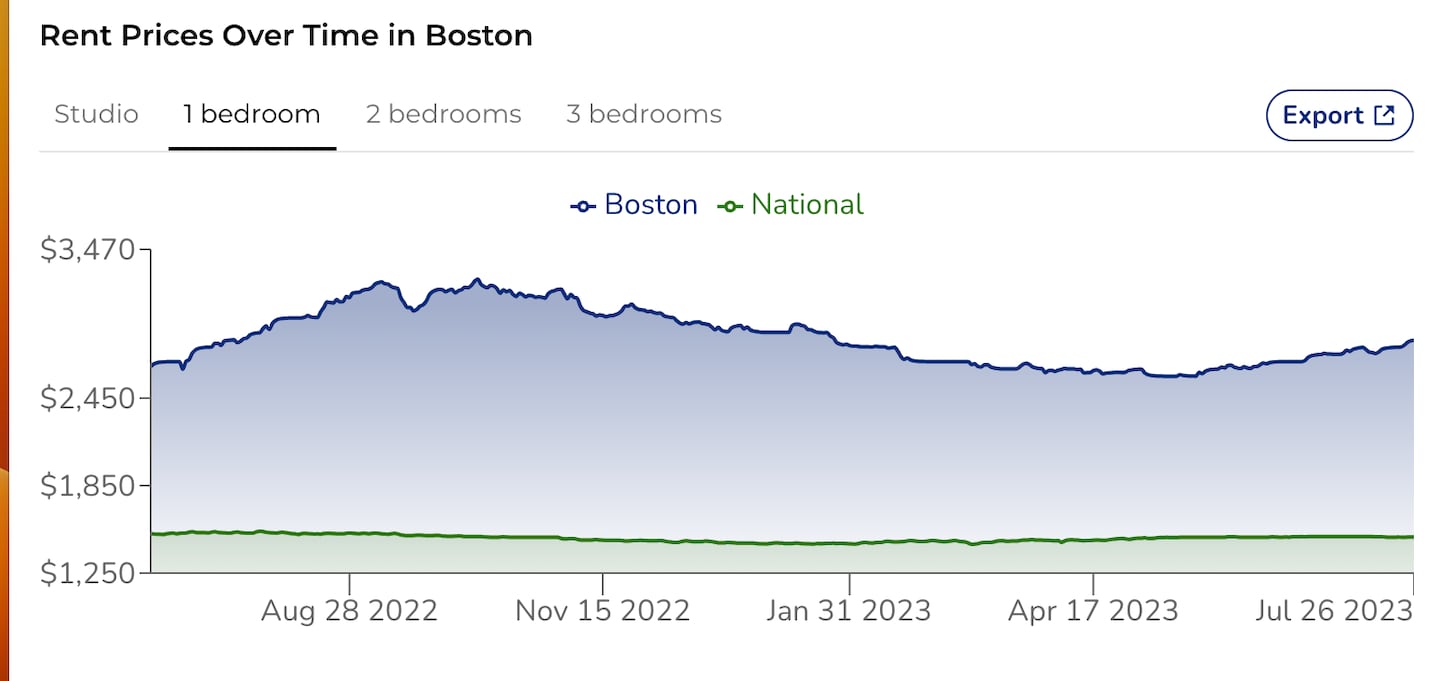

Median rent in Boston for a 1-bedroom apartment reached $2,700 in June -- a 6.3% increase from a year earlier, according to the website ApartmentAdvisor.

NORTH END DREAM

Once she began her apartment search this summer, Ford said she quickly learned her dream – of moving to Boston with her occupational therapy degree and launching her career – would be more expensive than she ever imagined.

She faced an up-front cost of $6,000 to rent an apartment: four $1,500 payments for first and last month’s rent, security deposit and broker fee.

“All they do is show up, give you a tour around the apartment and they’re like: ‘Okay where’s my money?’” Ford said.

“They were like: ‘Oh you have 3 payments, the one payment is first and last month, the second is security, and the third is broker,” Ford said. “They kind of tricked my brain. Three is still ridiculous, but it’s actually four.”

Ford said the broker gave her an extra week to pay the broker fee.

But still, she said she doesn’t understand why broker fees can cost renters thousands of dollars.

“It’s just difficult because I was feeling frustrated and I was trying to not be like rude or irrational,” Ford said. “But when they were talking about broker fees, I was like: ‘I found this place myself. I looked at all the Craigslist listings, all the Facebook, all the Zillow, all the everything. I found it. I reached out to them. I wanted to tour it. And that’s like 20 minutes of their time. To tour the apartment, answer some questions. But other than that, they literally did no work whatsoever.”

Ford said she ended up taking out a loan to afford the cost relocating to Boston – a decision she said she wishes she reconsidered.

“It’s really hard,” she said. “Boston is one of the most expensive places to live. And sometimes I’m like, it’s kind of silly, I wanted to be here because it’s so expensive, but it’s so beautiful.”

WHAT DO BROKERS DO?

Landlords are only allowed to charge tenants first month, last month, security deposit and the cost of a new lock.

Application fees charged by landlords are illegal, for example.

At the same time, brokers can charge fees for finding homes for tenants.

Brokers – who are licensed and regulated by the state – can “find dwelling accommodations for prospective tenants for a fee” under Massachusetts state law.

State law defines real estate brokers as anyone who charges a “fee, commission or other valuable consideration” for services including “assist[ing] or direct[ing] in the procuring of prospects or the negotiation or completion of any agreement or transaction.. of any real estate.”

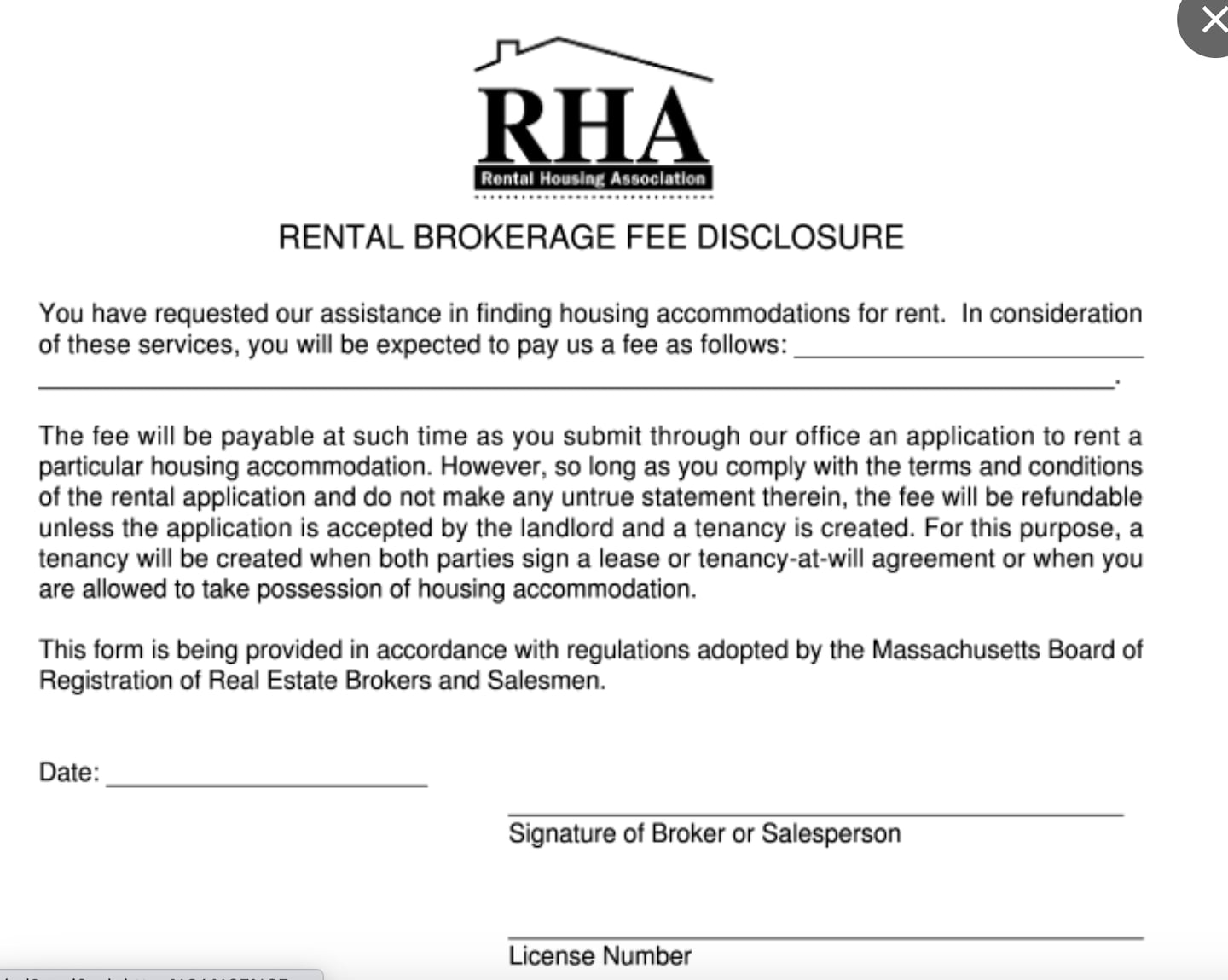

Brokers must provide prospective tenants with a form that outlines details about the fee: including amount, due date, manner of payment and broker license number.

Broker services include advertising a listing, showing properties, communicating with prospective tenants, assisting with credit checks and handling rental paperwork including leases and applications.

Greg Vasil, President and CEO of Greater Boston Real Estate Board, said a broker fee is a contractual arrangement between real estate agents and tenants.

“If a consumer is uncomfortable with any fee that is being assessed they should discuss that up front with the agent and the property owner,” Vasil said in an email.

“The fees are also a crucial source of income for real estate agents, many of whom rely on them to support themselves and their families,” he added.

Landlords who have other full-time jobs or who live out-of-state rely on real estate agents to show properties and interact with prospective tenants, according to Salpoglou.

“The leasing agent is doing a tremendous amount of warm calling, digging into their database,” Salpoglou said. “Quite frankly, most people don’t want to make cold calls or make warm calls or make tons of calls or go knock on doors. And that’s what a professional apartment leasing agent does.”

“They spend a lot of time to make that commission, although it may not appear that way,” Salpoglou said.

OTHER OPTIONS FOR LANDLORDS

Meanwhile, Worcester landlord Doug Quattrochi, who heads nonprofit MassLandlords.net, said he was shocked to learn how common hefty broker fees are around Boston.

“I think the question is how much work is the broker really doing to get that apartment filled and are those fees really commensurate with that level of effort?” Quattrochi said. “I think a lot of people really have questions about that.”

Quattrochi said he encourages landlords to handle the tenant search themselves – and says landlords outside of Boston tend to do so.

“You can do a lot of free checks to evaluate whether someone is likely to qualify before you’ve charged them any money,” Quattrochi said.

Credit checks can cost around $25 to $75. It’s free to post apartments on sites like Zillow.com, which also offers a premium listing option for $29.99.

And paperwork costs have declined with the rise of online document signing.

Quattrochi said the high demand makes it easy to find tenants: landlords often find themselves inundated with interest once they list an apartment on a site like Facebook Marketplace, he said.

“We’re absorbing probably our cost of time plus the one $50 fee to verify stuff on the one winning application,” Quattrochi said. “And so it seems to me like brokers would have to be doing an awful lot of work for a renter to justify a month’s rent finding free.”

HOW COMMON ARE BROKER FEES?

About 12.7% of landlords are currently offering to pay the broker fee – according to Salpoglou’s analysis of his database of over 90,000 units in Boston.

That figure is roughly in line with a 2020 estimate that said broker fees cost Boston renters an estimated $100 to $200 million in a typical year.

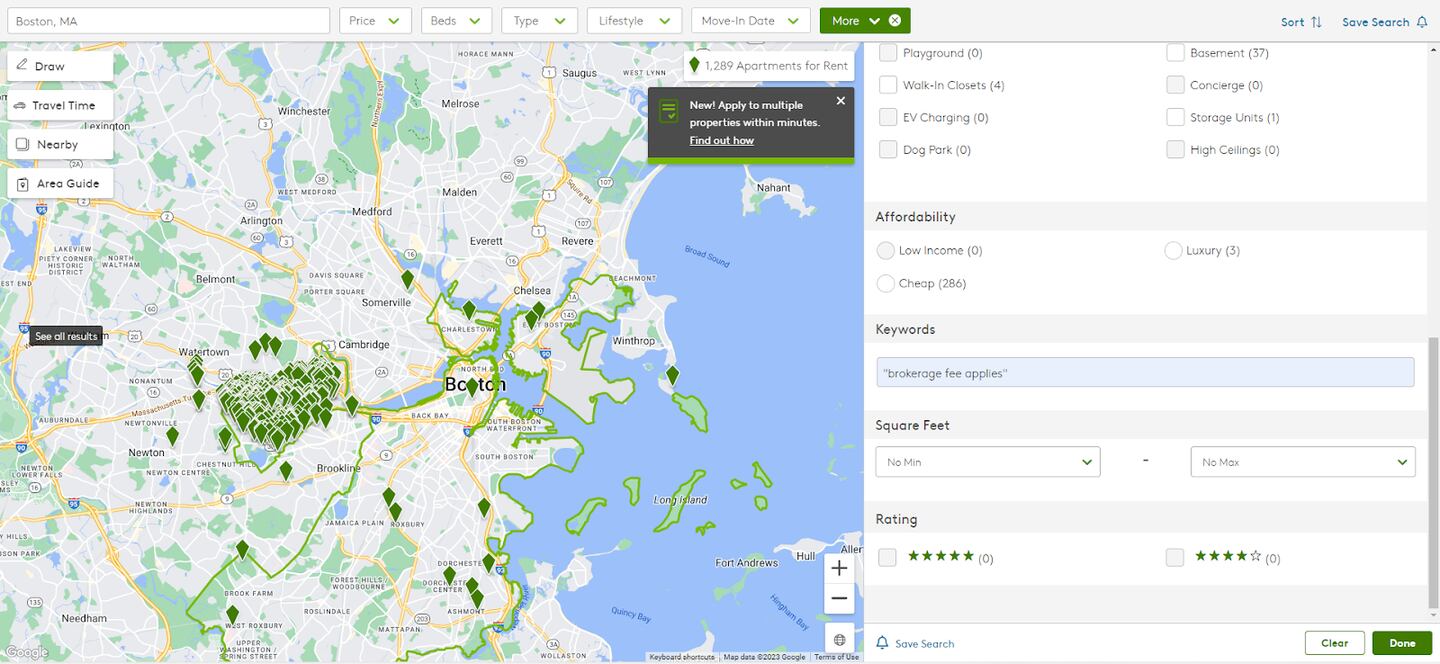

25 News scraped data from Apartments.com to get a sense of how common broker fees are this summer.

On a recent June day, Apartments.com listed tens of thousands of apartments for rent in Boston.

25 News found 130 apartment listings offered “no broker fees.”

In some instances, landlords in MA pay broker fees themselves – a trend that some housing advocates told 25 News they noticed at the onset of the pandemic.

But hundreds of listings required broker fees.

Nearly 1,300 listings said “brokerage fee applies.” Many listings were in Allston – a mainstay for the multitudes of students studying at Boston’s numerous colleges and universities.

And 426 listings required a “month broker fee.”

There’s no cap on broker fees.

Broker fees ranged as high as $4,175 for a one-bedroom apartment on Shawmut Avenue in Boston.

A one-bedroom apartment on Lopez Avenue in Cambridge had an up-front cost of $16,400 – including a $4,100 broker fee.

A one-bedroom luxury apartment in Somerville on Cross Street cost $3,200 for a broker fee – for a total of $12,800 up-front cost to rent along with a $25-per-person application fee.

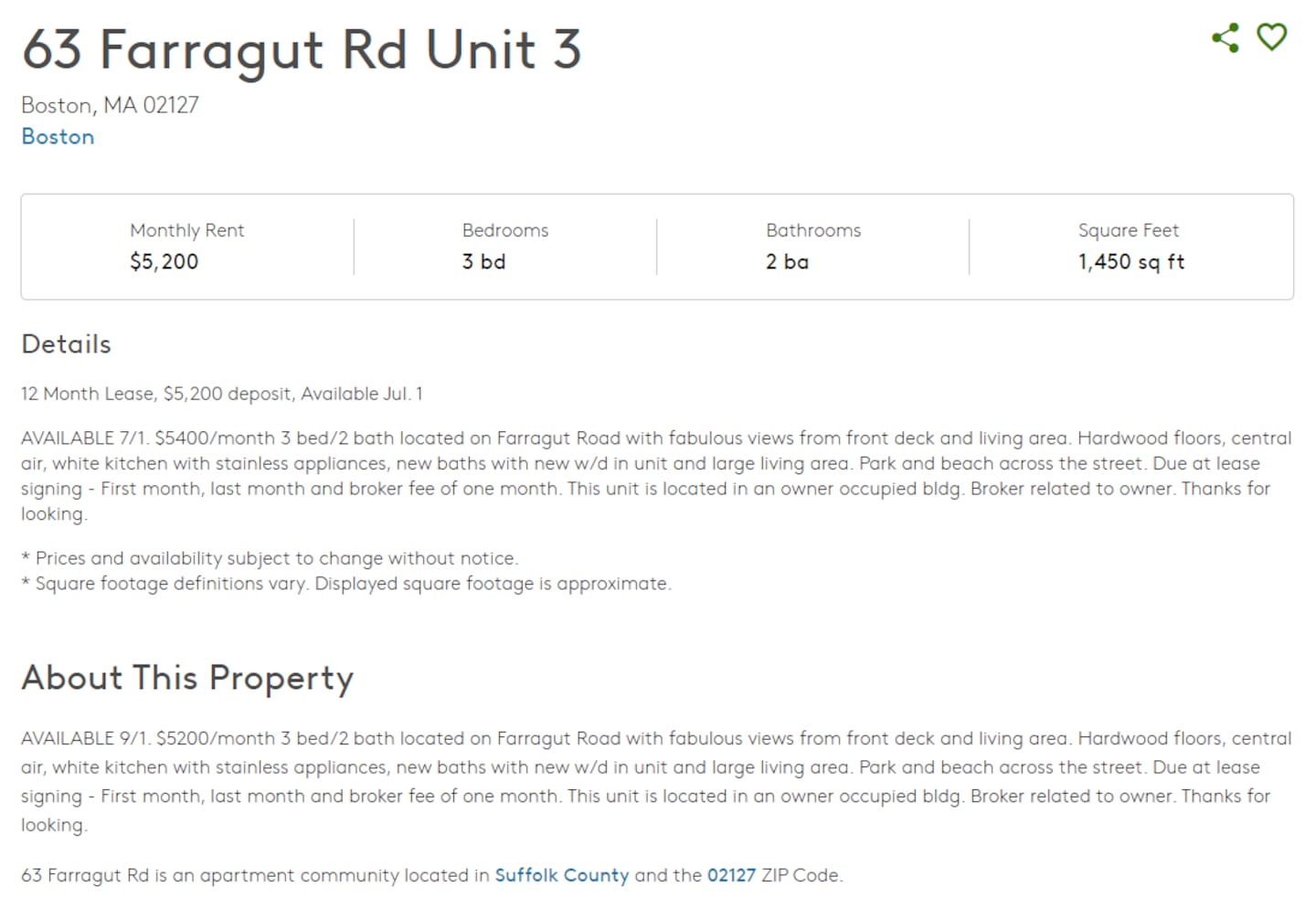

In at least one instance, a listing on Farragut Street disclosed a relationship between the broker and owner of an apartment.

BROKER FEES AND THE HOUSING CRISIS

Broker fees can exacerbate housing instability and homelessness experienced by vulnerable communities, say experts.

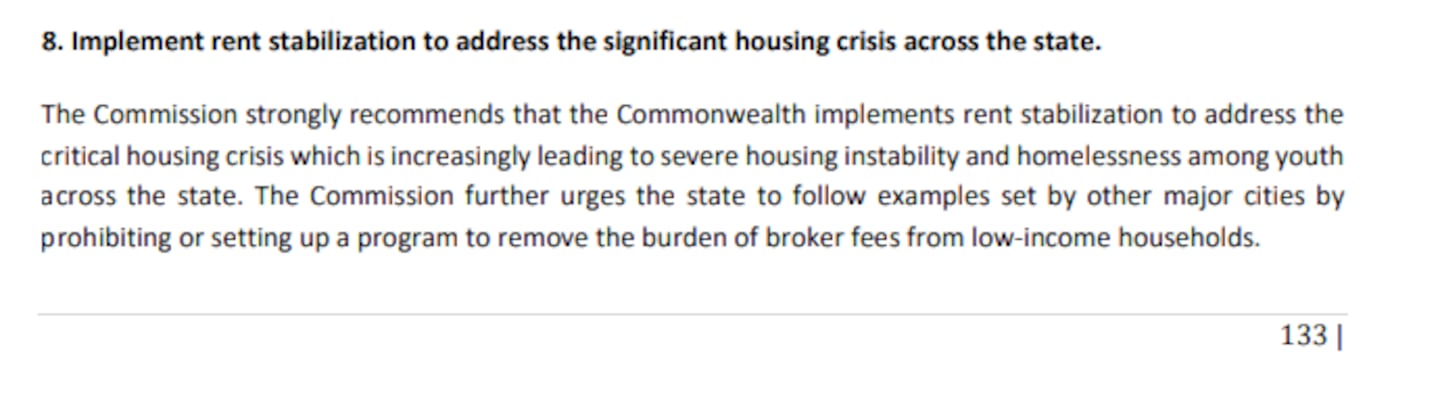

For example: the Massachusetts Commission on Lesbian, Gay, Bisexual, Transgender, Queer, and Questioning Youth recently recommended that Massachusetts follow examples from other cities by prohibiting broker fees, or removing the burden of those fees for low-income households.

The price of admission to rent in Boston has indeed become a barrier for many people, according to Johnson of Boston’s Office of Housing Stability.

Johnson said she’s concerned the real estate industry can use broker fees to skirt federal fair housing laws.

“It’s one way to weed out certain people by putting these high prices for broker fees,” Johnson said. “There are Fair Housing laws that are built around that, that are built to protect tenants who are part of a protected class, who are being discriminated against. And we definitely see in certain neighborhoods that the prices for broker fees, the prices for first, last, security are very high. And it’s another way to get around the Fair Housing laws in terms of making sure that everyone has access to live where they want to live in the neighborhood or community that they want to live in.”

Having to pay a one-time broker fee for a move also makes it harder for a tenant to move if a landlord raises the rent.

Suffolk professor Matthews manages a clinic where law students work with low-income renters to find alternative affordable housing.

Broker fees are a particular barrier for tenants who use rental vouchers and struggle to afford “exorbitant” upfront fees, according to Matthews.

“It really limits their housing choice significantly,” Matthews said.

“As a result they may end up in poor neighborhoods or poor quality housing,” he said.

BILL TO CRACK DOWN ON BROKER FEES

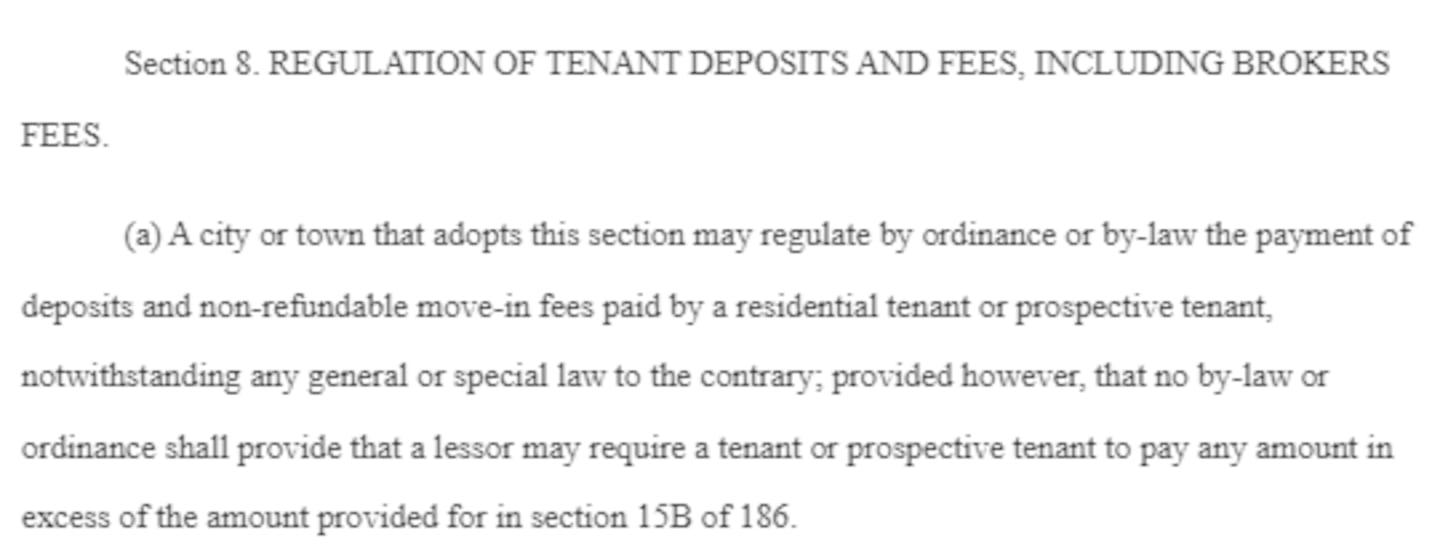

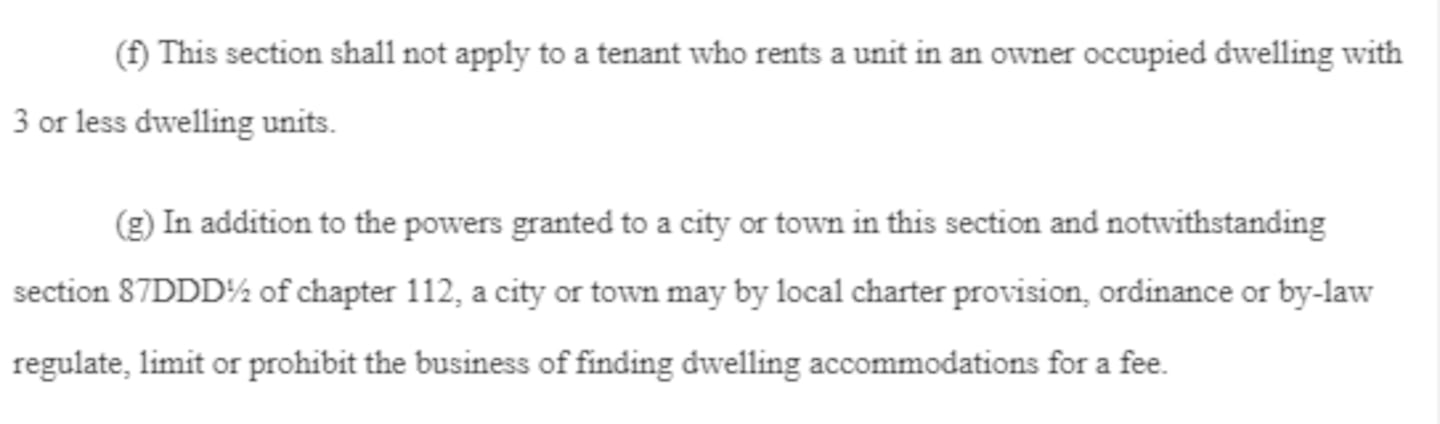

Senator James Eldridge, a Democrat, is sponsoring a rent control bill that would also allow towns and cities to regulate broker fees.

The bill would let cities or towns “regulate, limit or prohibit the business of finding dwelling accommodations for a fee.”

Eldridge said it’s time to let communities themselves decide whether to limit any tenant fees.

25 News asked Cambridge, Somerville and Boston mayors if they’d regulate broker fees if the bill passes.

Cambridge Mayor Sumbul Siddiqui said she supports legislation to help relieve the burden of finding an apartment in the costly rental market.

Landlord Quattrochi called Eldridge’s bill a “complete nonstarter” and said it will likely draw opposition from landlords and brokers alike.

Eldridge’s bill would also provide more tenant protections, and allow cities or towns to pass regulations limiting rental increases.

“The new circumstances are so difficult for landlords to operate under,” Quattrochi said.

Quattrochi said a potential local mandate for installment payments for security deposit and last month’s rent could have consequences for landlords: “That’s going to be a huge, huge risk factor for us because we want to know that a household has had the ability to save up at least some moving money.”

Currently, cities need legislative approval to ban broker fees.

Lawmakers are considering bills to ban broker fees in Northampton and Brockton.

Northampton city councilors cited a 2019 report that found broker fees on top of other up-front costs “constitute significant barriers to fair housing in the city.”

Former Boston Mayor Marty Walsh launched a working group to study broker fees in early 2020 – but the group never got off the ground amid the pandemic.

Other states have seen big fights over broker fees.

In 2019, New York passed a law with sweeping protections for tenants.

The state department of state in 2020 said that the law required landlords to pay broker fees – not tenants.

But the real estate industry mounted a legal challenge and argued the law would put people out of work.

By spring 2021, broker fees for tenants were legal again in NYC.

INDUSTRY BACKLASH

Real estate groups have opposed efforts to regulate broker fees in Massachusetts and New York City.

Last August, the Massachusetts Association of Realtors’ website cheered the group’s successful defeat of “broker fee shifting” in the 2022 legislative session.

“We successfully blocked rent control, eviction moratoria, broker fee shifting…,” reads the Massachusetts Association of Realtors’ August 2022 update.

Industry lobbyists have argued rent will just go up if landlords have to shoulder broker fees.

In New York City, the state realtors association is fighting a bill that would require the party that hires a broker to pay the broker fee.

“Many of the same professionals whose compensation model would be altered under this legislation are struggling to pay rent – a cost that this bill would only exacerbate,” NYSAR lobbyist Michael Kelly wrote in a June opposition memorandum. “This is because landlords will be forced to raise monthly rents to compensate real estate brokers if they cannot charge the prospective tenant a broker’s fee. At the same time that it would increase rents, this bill would put the future of broker compensation for rental transactions in New York City on shaky ground.”

Kelly also raised concerns that landlords would turn to “unlicensed screeners who are not required to undergo fair housing training and adhere to state licensing requirements.”

City Council Member Chi Ossé, a former tenants lawyer, said it’s “common-sense.”

“This bill is simple and fair in assigning that cost to whoever sought the service,” Ossé said in a June press release. “Also, to address the fear that landlords who pay the fee would simply pass the costs onto tenants: It should be noted that even if some portion of the cost were passed onto tenants as rent, it would be distributed over the course of 12 or 24 months, alleviating the prohibitive upfront costs.”

BROKER FEE COMPLAINTS

Boston’s Office of Housing Stability gets about 400 calls a day – according to Deputy Director Johnson.

“I would say about half of those calls are related to fees that landlords are charging them,” Johnson said.

“A big part of those fees are broker fees,” Johnson said. “In terms of: ‘Can my landlord charge me this much for a broker fee?”

The top complaint that Boston’s housing office gets about broker fees?

“A lot of times tenants will say, I found this unit myself,” Johnson said. “‘I’m not sure exactly what I’m paying the broker or why I’m even paying the broker because they didn’t provide any type of service.’”

Johnson said tenants can file consumer complaints with the state attorney general’s office if they feel a broker is engaged in unfair and deceptive practices.

In the high-stakes Boston market, Johnson acknowledged that tenants can feel pressured to accept fees to secure housing without challenging their legality.

“We found that a lot of tenants don’t feel comfortable because they need a place to live,” Johnson said.

But Johnson said the AG office can investigate whether a broker worked to find someone an apartment.

She acknowledged: “It’s hard to prove whether or not someone has actually done the work in finding housing.”

Johnson said she advises tenants to log of all the work they’ve done to find housing: including calls and voicemails left to landlords.

“We try to make sure that tenants are equipped and have the record that they need to show that I did this on my own, there’s no need for me to pay for this broker,” Johnson said.

And Johnson said it’s possible to negotiate payment plans.

She said her office can recommend brokers who allow such flexibility.

“People come from different socioeconomic backgrounds and may not be able to pay $1500 upfront, but they may be able to pay half of that one month and half the next month,” Johnson said.

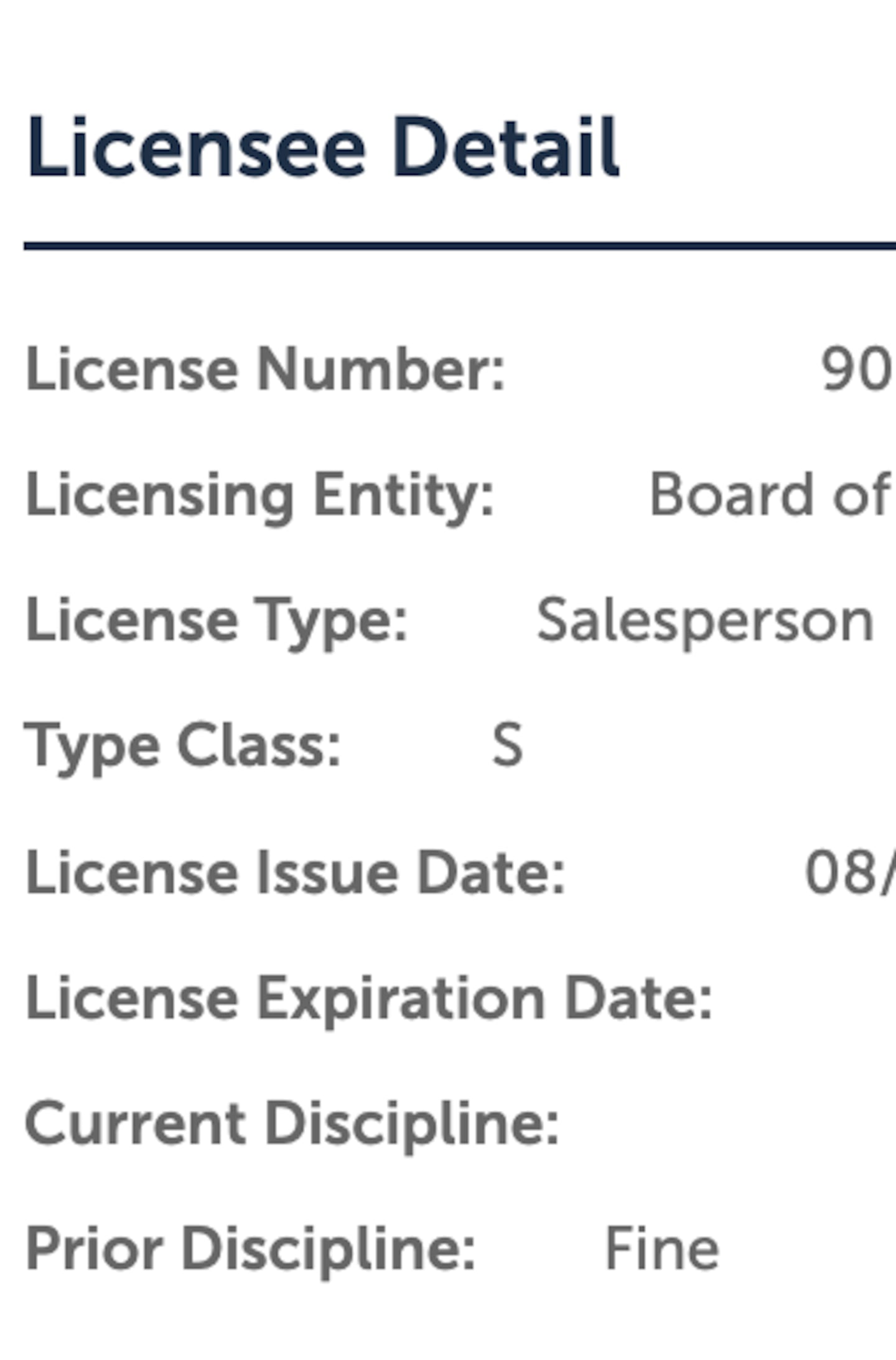

Anyone can look up whether an individual has a broker license on the state Division of Occupational Licensure website.

“You can type in their name and it’ll come up and tell you whether or not they are a licensed broker,” Johnson said. “If you don’t see their name, that could be a red flag. And that’s when you want to reach out, either to the attorney general’s office, to our office, to the Office of Fair Housing.”

The state’s database states whether brokers have been disciplined in the past.

But unlike states like New Jersey, Massachusetts does not post details of prior license sanctions or post copies of disciplinary documents online.

25 News asked the state and Boston for data on complaints about broker fees.

Spokespeople for the Boston Office of Housing Stability, state Attorney General’s office and the Division of Professional Licensure said the offices don’t have specific breakdowns for such complaints.

The state Division of Professional Licensure provided a list of roughly 500 complaints about commercial and residential real estate brokers dating back to July 2018.

About 75 of those complaints resulted in a broker getting charged a fine, being put on probation, or having their license revoked.

The state attorney general’s office also has a database of consumer complaints.

In April, the AG’s office received a complaint about a Somerville building manager who allegedly charged realtor fees without a license.

Johnson said it’s far past time for a conversation about what brokers are supposed to do and what they can charge.

“How are brokers actually contracted?” Johnson said. “What is the scope of their work? So that when tenants or homebuyers or whomever are going to this person to pay a fee, it’s clear that they are paying what they’re supposed to pay. And it’s clear that they understand the work that has been done.”

- Resources for prospective tenants with questions about broker fees

- In Boston:

- Call the city’s Inspectional Services Department: 617-635-5300

- Call 311

- Anywhere in MA:

- Attorney General’s Consumer Hotline at (617) 727-8400

- Division of Professional Licensure-- Consumer Complaint Line: 617-727-7406

Download the FREE Boston 25 News app for breaking news alerts.

Follow Boston 25 News on Facebook and Twitter. | Watch Boston 25 News NOW

©2023 Cox Media Group